Leveraging Open Interest Data in Options Trading: A Roadmap to Success

Using open interest (OI) data in option trading can provide valuable insights and help you make more informed decisions. Open interest refers to the total number of outstanding option contracts in the market for a specific strike price and expiration date.

Here are some ways to use OI data to potentially profit from option trading:

Identify liquidity and popularity:

Higher open interest typically indicates more liquid and popular options contracts. These options are easier to trade, as there is more buying and selling activity, reducing the bid-ask spread. Trading in liquid options can help you enter and exit positions with better pricing.

Spot potential trend reversals:

Changes in open interest can indicate shifts in market sentiment. Increasing open interest combined with rising prices may suggest a bullish trend, while increasing open interest with falling prices could indicate a bearish trend. Conversely, decreasing open interest might signal a potential trend reversal.

Confirm breakouts or breakdowns:

When the price of an underlying asset breaks out of a significant level of support or resistance, check if the corresponding options' open interest is also increasing. This can provide confirmation that the breakout or breakdown is significant and not just a false signal.

Identify option accumulation:

If open interest is rising while the price remains relatively stable, it could indicate that some traders are accumulating positions, potentially expecting a big move in the underlying asset. This can help you anticipate potential large price swings.

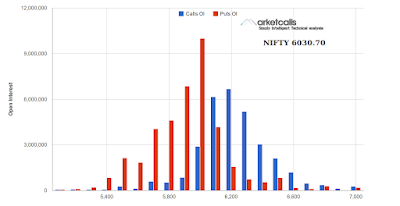

Identify potential support and resistance levels:

High open interest at specific strike prices can act as support or resistance levels for the underlying asset's price. Traders often focus on these levels when making trading decisions.

Watch for option expirations:

Significant open interest at specific strike prices near expiration can create "pinning" effects, where the underlying asset's price is drawn toward those levels at expiration. This can be exploited by option traders.

Monitor changes in open interest:

Pay attention to changes in open interest, especially for large, sudden increases or decreases. This can provide insights into market sentiment and potential upcoming events or news.

Use with other indicators:

Combine open interest data with other technical indicators and fundamental analysis to make well-rounded trading decisions. Avoid making trading decisions solely based on open interest without considering other factors.

Remember that options trading involves significant risks, and past open interest data does not guarantee future results. Always perform thorough research, use risk management strategies, and consider consulting with a financial advisor before engaging in options trading or any other form of investment.

Comments

Post a Comment