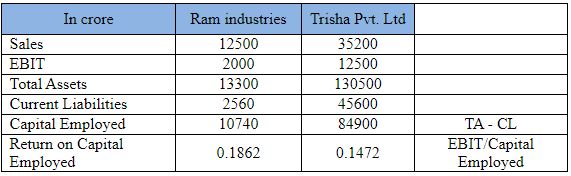

Ratio, Interpretation, and Example of Return on Capital Employed (ROCE)

What Is Return on Capital Employed (ROCE)? Return on capital employed (ROCE) is a financial ratio used to analyse a company's profitability and capital utilisation. In other words, this ratio can help to identify how well a company generates profits from its capital as it is applied. ROCE is one of the many financial indicators available to financial managers, stakeholders, and retail investors when considering a company for investment. Higher ratios usually indicate that a company is profitable. · Income from investment a financial ratio that analyzes a business's profitability when all of its capital is put to use. · ROCE and return on invested capital are closely related concepts. In the end, the ROCE calculation reveals how much profit a business is making for every ₹1 of invested capital. The more profit a company can make for every ₹1, the better. Therefore, greater profitability across firm comparisons is indicated by a hig