Ratio, Interpretation, and Example of Return on Capital Employed (ROCE)

What Is Return on Capital Employed (ROCE)?

Return on capital employed (ROCE) is a financial ratio used to analyse a company's profitability and capital utilisation. In other words, this ratio can help to identify how well a company generates profits from its capital as it is applied. ROCE is one of the many financial indicators available to financial managers, stakeholders, and retail investors when considering a company for investment.

Higher ratios usually indicate that a company is profitable.

·

Income from investment a financial ratio that

analyzes a business's profitability when all of its capital is put to use.

· ROCE and return on invested capital are closely related concepts.

In the end, the ROCE calculation reveals how much profit a business is making for every ₹1 of invested capital. The more profit a company can make for every ₹1, the better. Therefore, greater profitability across firm comparisons is indicated by a higher ROCE.

How to Determine ROCE?

ROCE = EBIT/ Capital

Employed

where:

EBIT=Earnings before interest and tax

Capital Employed=Total assets − Current liabilities

Example of ROCE

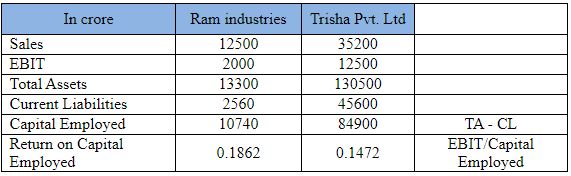

Take Ram industries and Trisha Pvt. Ltd., two businesses that are involved in the same sector of the economy. A hypothetical ROCE study of both companies is presented in the table below.

As you can see, Trisha Pvt. Ltd.

has far more sales, EBIT, and total assets than Ram Industries. But when you

look at the ROCE indicator, you can see that Ram Industries is employing its

capital more profitably than Trisha Pvt.

Trisha Pvt Ltd. ROCE .'s is

14.72% per capital rupee, but Ram Industries ROCE is 18.62% per capital

rupee.

FAQ

What Does It Mean to Put Capital to Work?

Businesses use capital to run their operations, invest in

new opportunities, and grow. Capital employed is defined as a company's total

assets minus current liabilities. Capital employed is useful because it is used

in conjunction with other financial metrics to determine the return on a

company's assets and how effective management is at employing capital.

Why Is ROCE Important When We Already Have ROE and ROA

Metrics?

Return on capital employed is preferred by some analysts

over return on equity and return on assets because it takes into account both

debt and equity financing. These investors believe that return on capital is a

better indicator of a company's long-term performance or profitability.

How Do You Calculate Return on Capital Employed?

Divide net operating profit, or earnings before interest and

taxes, by capital employed to calculate return on capital employed. Another

method is to divide earnings before interest and taxes by the difference

between total assets and current liabilities.

What Is an Appropriate ROCE Value?

While no industry standard exists, a higher return on

capital employed indicates a more efficient company in terms of capital

employment. A lower number, on the other hand, may indicate a company with a

lot of cash on hand, because cash is included in total assets. As a result,

large amounts of cash can occasionally skew this metric.

Comments

Post a Comment