How to Select the Perfect Stock for Intraday Trading

Intraday trading is a popular form of trading in the stock market, where traders buy and sell stocks within the same trading day. Intraday traders aim to make profits by taking advantage of small price movements in the market. However, selecting the right stock for intraday trading can be a challenging task, and requires a lot of research and analysis. In this blog, we will discuss some essential factors that you need to consider while selecting a stock for intraday trading.

Liquidity

Liquidity is one of the most important factors to consider while selecting a stock for intraday trading. Liquidity refers to the ability of a stock to be bought and sold quickly, without affecting the price of the stock. Stocks with high liquidity are easier to buy and sell, and are less risky for intraday trading. Blue-chip stocks, which are large and well-established companies, are usually the most liquid stocks in the market.

Volatility

Volatility is the degree of variation of a stock's price over a period of time. Stocks with high volatility are more likely to experience rapid price movements, making them ideal for intraday trading. However, high volatility also means higher risk, and traders need to be careful while trading such stocks. Low volatility stocks may not provide the required profit potential for intraday traders.

Technical Analysis

Technical analysis is a method of analyzing stocks using charts and technical indicators. It involves studying the price and volume data of a stock to identify trends and patterns that can help predict future price movements. Technical analysis is a popular tool used by intraday traders to make trading decisions. Traders use technical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify buy and sell signals.

Fundamental Analysis

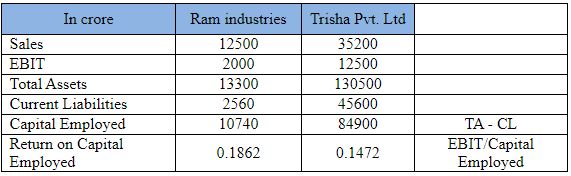

Fundamental analysis involves analyzing a company's financial statements and other economic indicators to determine the intrinsic value of a stock. Intraday traders may not be interested in the long-term prospects of a company, but understanding the fundamentals of a stock can help traders make informed trading decisions. Key financial indicators like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE) can provide valuable insights into a company's financial health.

News and Events

News and events can have a significant impact on the stock market, and intraday traders need to be aware of them. Major news like economic reports, company earnings announcements, and geopolitical events can cause sudden price movements in the market. Intraday traders can use news and event calendars to keep track of important events that may affect the stocks they are trading.

Risk Management

Risk management is a crucial aspect of intraday trading. Intraday traders need to have a solid understanding of risk management techniques like stop-loss orders and position sizing. Stop-loss orders can help limit the losses in case a trade goes against the trader's expectations. Position sizing refers to the amount of capital that a trader allocates to a particular trade, based on the risk involved.

Conclusion

Selecting the right stock for intraday trading can be a daunting task, but with the right research and analysis, traders can increase their chances of success. Liquidity, volatility, technical analysis, fundamental analysis, news and events, and risk management are some essential factors that traders need to consider while selecting a stock for intraday trading. Traders should also keep in mind that intraday trading is a high-risk activity and should only be undertaken after careful consideration and proper risk management.

Comments

Post a Comment