What Is the Meaning of Return on Equity?

What Is the Meaning of

Return on Equity?

A measurement of financial

performance known as return on equity (ROE) is obtained by dividing net income

by shareholders' equity. ROE is referred to as the return on net assets since

shareholders' equity is determined by deducting a company's debt from its

assets.

ROE is considered to be an

indicator of a company's profitability and efficiency in generating profits.

The higher the ROE, the more effective management is at producing income and

growth from equity capital.

How to Determine Return

on Equity (ROE)?

Any corporation can calculate its

ROE in percentage form if its net income and equity are both positive levels.

Before dividends given to common shareholders, after dividends to preferred

shareholders, and before interest paid to lenders, net income is computed.

Net income is the sum of a

company's income, net expenses, and taxes for a specific time period. In order

to compute average shareholders' equity, equity at the beginning of the period

is added. The period shall start and conclude at the same time as the period in

which the net income is earned.

The income statement includes net

income for the most recent full financial year, often known as the trailing 12

months, which is a total of the financial activities during that time. The

balance sheet, which is a running balance of all changes in a company's assets

and liabilities over time, is where investors can find their equity.

Because of the difference between

the income statement and the balance sheet, it is regarded best practise to

compute ROE using average equity over a period.

What Does Return on

Equity Demonstrate?

The normal ROE for a stock's

competitors will determine whether a ROE is considered good or poor. For

instance, companies have a large number of assets and debt on their balance

sheet, but only a tiny amount of net revenue. In the utilities industry, a

typical ROE can be 10% or less. A retail or technology company with lower

balance sheet accounts in relation to net income may typically have ROE levels

of 15% or higher.

A decent rule of thumb is to aim

for a ROE that is equal to or slightly higher than the average for the

company's sector—those in the same industry. Assume a company, ITC, has

consistently maintained a ROE of 20% for the last few years, compared to the

16% average of its competitors. An investor might conclude that ITC's

management is above average at making profit from the company's assets.

Identifying Issues

Using Return on Equity.

It's understandable to wonder why

an average or slightly above-average ROE is better to a ROE that is twice,

triple, or even four times that of its peer group. Aren't equities with a high

ROE a better investment?

Sometimes a very high ROE is a

positive thing if a company's net income is extremely high compared to equity

due to its outstanding performance. However, a very high ROE is frequently

caused by a small equity account in comparison to net income, signalling risk.

ROE limitations.

A high ROE is not necessarily a

good thing. An excessive ROE may be a sign of a variety of problems, including

irregular profits or high levels of debt. Additionally, a company's ROE cannot

be evaluated or compared to other companies with a positive ROE if it is

negative due to a net loss or negative shareholders' equity.

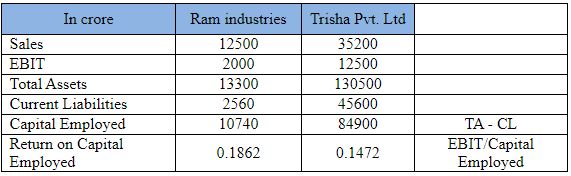

A good example of

return on equity in the Indian stock market.

FAQ’s

What Makes a Strong

ROE?

What constitutes a

"good" ROE will vary depending on the industry and rivals of the

company, as is the case with most other performance indicators. Although the

NSE's long-term ROE has generally remained around 18%, individual

industries might have much higher or lower values.

If all else is equal, a highly

competitive industry that needs expensive assets to make money will probably

have a lower average ROE. The average ROE may be higher in sectors with fewer

competitors and a lower capital expenditure requirement for revenue generation.

How is ROE determined?

Analysts simply divide the net

income of the company by the average amount of shareholders' equity to arrive

at ROE. Shareholders' equity, which is equal to assets minus liabilities, can

be thought of as a measurement of the return produced on the company's net

assets. An average shareholders' equity is utilised since the equity amount can

change over the course of the accounting period in issue.

What Separates Return

on Equity (ROE) from Return on Assets (ROA)?

Both return on equity (ROE) and

return on assets (ROA) aim to determine how well a company earns money. The

difference between the two measures is that ROE compares net income to the

company's net assets, whereas ROA compares net income to the company's assets

only, omitting its liabilities. In both scenarios, businesses in sectors where

operating costs are high are expected to have lower average returns.

What Occurs If ROE Is

Negative?

If a company's ROE is negative,

it indicates that its net income for the relevant period was negative (i.e., a

loss). This suggests that investors are losing money on their stock ownership

in the company. A negative ROE is common for young, expanding businesses;

however, if it continues, it may indicate problems.

What Leads to an

Increase in ROE?

All else being equal, ROE will

rise as net income rises. Another method for increasing ROE is to diminish the

value of shareholders' equity. Because equity equals assets minus liabilities,

raising liabilities (e.g., taking on additional debt financing) is one

technique to raise ROE without necessarily boosting profitability. This is

exacerbated if the debt is used to fund share repurchases, essentially lowering

the amount of stock available.

Comments

Post a Comment